colorado estate tax form

DR 0104EE- Colorado Easy Enrollment Information Form DR 0104EP- Individual Estimated Income Tax Payment Form. In other words when an estate is passed on the federal government taxes the transfer.

Printable Tax Prep Checklist On White Background With A Calculator Pencils And 1040 Form Tax Prep Checklist Tax Prep Tax Checklist

Ad Filing your taxes just became easier.

. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for. Start filing for free online now.

The estate tax is levied on an estate after a person has. Estate income tax is a tax on income like interest and dividends. Over 85 million taxes filed with TaxAct.

If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and. The estate tax is a tax applied on the transfer of a deceased persons assets. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004.

Application for Property Tax Exemption. 0 Fed 1499 State. DR 0104PN - Part-Year ResidentNonresident Tax Calculation Schedule DR.

Form 104PN - Nonresident Income Tax Return. Colorado Part-YearNonresident Tax Calculation Schedule 2021. However estate income tax returns can be fairly complex even if there is very little income.

DS 056S - Personal Property Short Form DS 058 - Renewable Energy Property DS 060 - Lessor Personal Property DS 155 - Residential Personal Property DS 618 - Coal Real and Personal. Start filing for free online now. File your taxes stress-free online with TaxAct.

Nonresidents of Colorado who need to file income taxes in the state need to file Form 104PN. Application forms are available from the Colorado Department of Military and Veterans Affairs Division of Veterans Affairs 7465 E. 2021 Consumer Use Tax Reporting.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Ad Filing your taxes just became easier. Ad The Leading Online Publisher of Colorado-specific Legal Documents.

Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or. Colorado 2 withholding form and instructions. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

There is no estate tax in Colorado. It is one of 38 states with no estate tax. Colorado Estate Tax.

Use schedule e on the fiduciary income tax return dr 0105 to make the apportionment. File your taxes stress-free online with TaxAct. Form 104EP - Estimated Individual.

If the date of death occurs prior to December 31 2004 Form DR 1210. Colorado estate tax form. Ad From Fisher Investments 40 years managing money and helping thousands of families.

If you are a personal. 220 rows Forms Requests To request a form be sent to you via email or USPS standard mail. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

1st Avenue Suite C Denver CO 80230. Get Access to the Largest Online Library of Legal Forms for Any State. What Is the Estate Tax.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Over 85 million taxes filed with TaxAct. Forms are mailed by March 1.

DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. 2022 Colorado Estimated Income Tax Payment Form.

Estate Income Tax Return When Is It Due

How To File Taxes For Free In 2022 Money

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

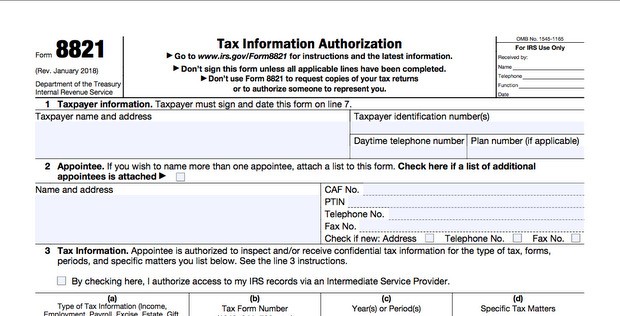

What Is Form 8821 Or Tax Guard Excel Capital Management

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

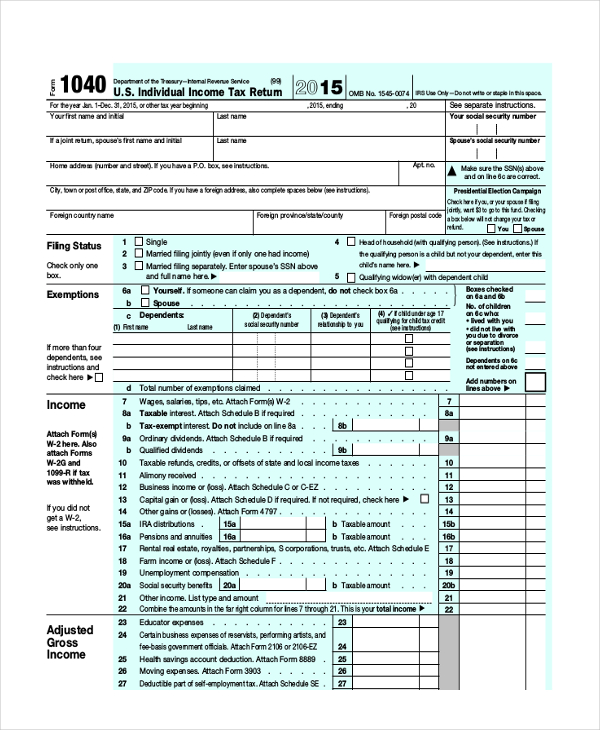

Free 9 Sample Federal Tax Forms In Pdf Ms Word

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Filing A Schedule C For An Llc H R Block

Colorado Tax Form 104 Printable Fill Online Printable Fillable Blank Pdffiller

Irs Form 56 Instructions Overview Community Tax

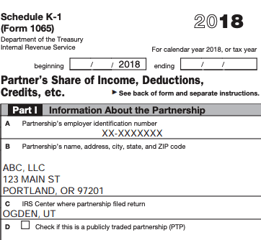

Understanding The 1065 Form Scalefactor

Understand Forms And Tax Tips For Increasing Your Refund Tax Refund Tax Help Tax Services

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

W 4 2021 Printable Il Employee Tax Forms Form Example Irs Forms

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet